The world has entered an unprecedented “big deal moment”, and new US President Donald Trump is the ringmaster of this chaotic circus. With his business-first mindset, Trump has turned diplomacy into a transactional marketplace where everything – tariffs, security, alliances – is up for negotiation.

The result? A global landscape teeming with uncertainty, where old rules are being shredded and self-interest reigns supreme.

As a researcher tracking these seismic shifts, I see a future defined by confrontation, counter-strategy and a relentless tug-of-war between the world’s powers. Buckle up – the ride is just beginning.

Trump’s approach has already flipped the script. Tariffs are now bargaining chips, security commitments come with price tags, and traditional alliances are crumbling under the weight of “America First”. Gone is the multi-polar dream of “win-win” cooperation, replaced by a grim zero-sum game. The great powers are jockeying for position, every policy a calculated jab, every compromise a hard-won concession. For businesses and individuals, this means a turbulent external environment – one in which adaptability will be the difference between prosperity and perdition.

Looking back at Trump’s foreign policy over the past few months, it’s clear that he’s playing offense on all fronts. China, the EU, Canada, Mexico and Russia have all felt the sting of his aggressive tactics. Chinese global companies in particular are reeling as tariffs and restrictions bite deep.

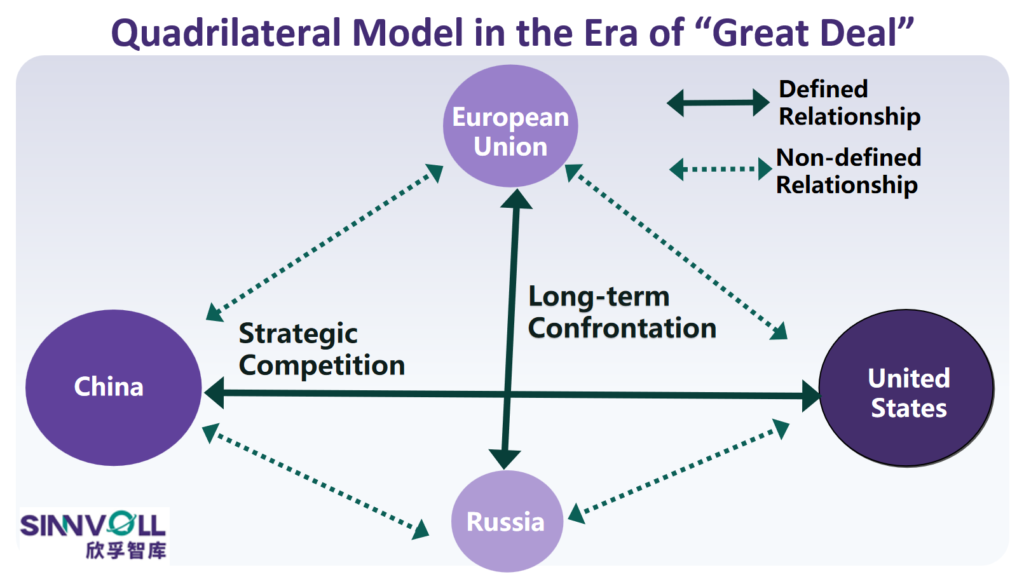

Analysts are fixated on two questions: When will there be a resolution, and how far will this escalation go? Amid the chaos, a new global order is taking shape – a “3+1” configuration: the United States, China and the EU as the heavyweights, with Russia dragged into the fray by the war in Ukraine. The shifting balance between these four will dictate the trajectory of the world and set the stage for business survival in this brave new era.

In this article, I’ll unpack this “3+1” pattern through the lens of Chinese global companies, highlighting the risks and opportunities in Trump’s deal-driven world.

My aim? To cut through the noise and help companies decode international macro shifts – so they can take advantage, avoid pitfalls and pivot with precision. The stakes are high and the clock is ticking. Let’s dive in.

How to understand the quadratic relationship?

The quadrilateral relationship has proven to be beyond the complexity of typical academic research and thus a puzzle for the business community.

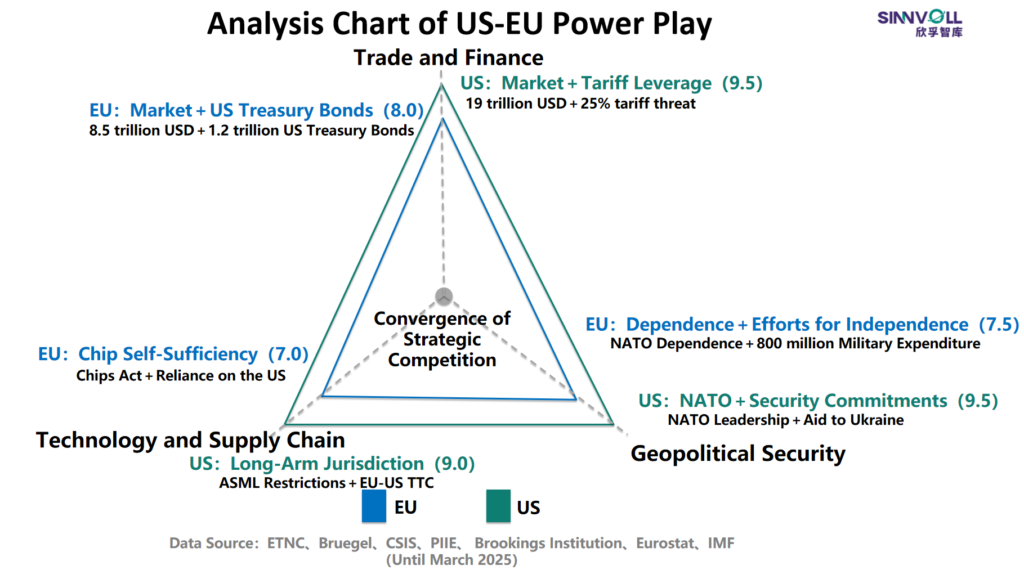

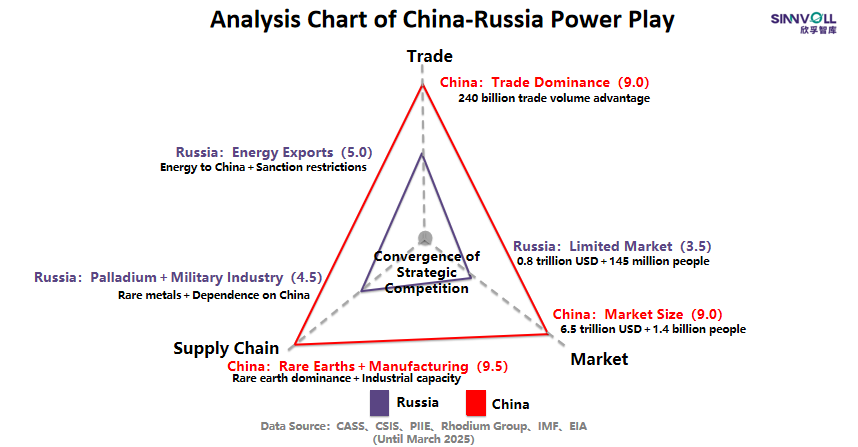

To help readers understand future geopolitical trends, our research team has conducted a modelling analysis of the relationship between China, the US, the EU and Russia. The current status, balancing mechanisms, deal potential and roles in the dynamic equilibrium have been outlined for each pair of relationships. This framework helps to understand the direction of development of the quadrilateral game, and the model below illustrates the current state of these four-party dynamics.

Based on our systematic research, the six relationships depicted in the diagram are analysed along three dimensions: “relationship status”, “balancing mechanisms” and “business potential”. The detailed analysis that follows is as follows:

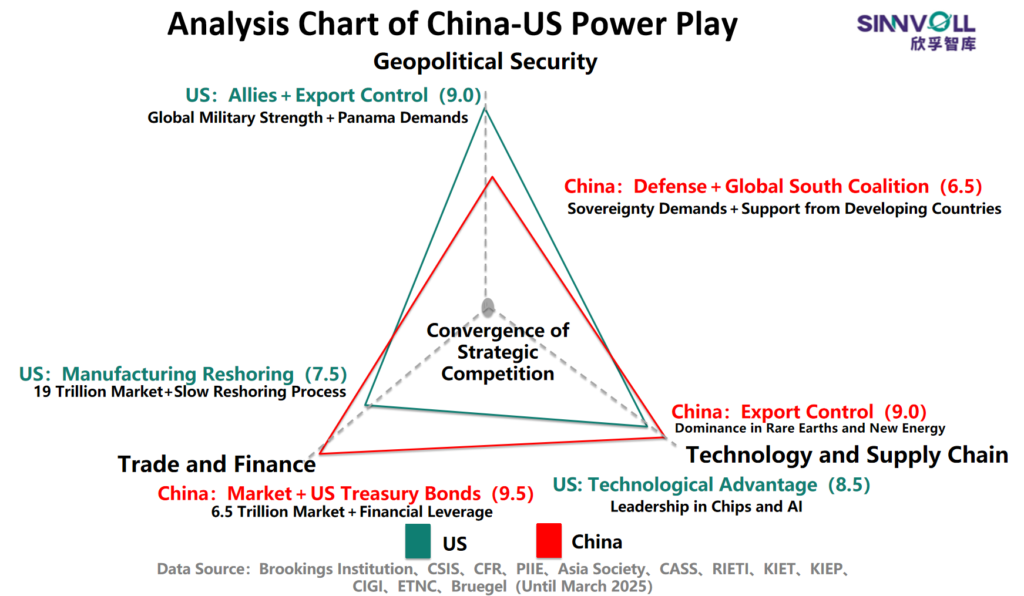

Relationship I: Sino-American Rivalry – A Strategic Deadlock with No Quick Fixes

The China-U.S. relationship is no longer a matter of fleeting tensions—it’s a confirmed strategic rivalry, one that’s locked in a long-term standoff. This isn’t a temporary spat amenable to short-term deals; it’s a defining global contest that transcends U.S. political cycles, whether Republicans or Democrats hold power. China leverages its economic resilience and growing geopolitical clout to challenge American dominance, while the U.S. counters with military might and technological barriers to hem in its rival. The result? A deadlock at the heart of what some call a “quadrilateral game,” where neither side can fully outmaneuver the other.

A Dance of Confrontation and Counterbalance

The past seven years have laid bare the stark dichotomy between these two powers. The U.S. has wielded two main weapons: a tariff offensive and a tech blockade. Tariffs began modestly with steel and aluminum but soon swelled to encompass solar panels, electric vehicles, and beyond—some levies on Chinese goods now soaring as high as 100%. Simultaneously, Washington has pursued a deliberate technological decoupling, targeting China’s high-tech sector with chip bans and export restrictions that strike at the core of Beijing’s ambitions.

China, far from standing idle, has fired back with precision. It’s tightened export controls on critical resources like rare earths and gallium—materials the world, including the U.S., relies on heavily. Beijing also holds a trump card: over $1 trillion in U.S. Treasury bonds, a financial deterrent that looms large in this economic chess match. The result is a stalemate often dubbed “Cold War 2.0.” Neither side can claim decisive victory, and the economic scales remain precariously balanced. IMF projections suggest China’s GDP might edge past America’s by just 15% by 2050—a gap too narrow to trigger a total collapse of the rivalry, yet wide enough to keep the pressure simmering.

China’s strides in fields like artificial intelligence only sharpen the tension, nudging the U.S. to double down on its containment strategy. This isn’t a relationship teetering on the brink of rupture—it’s one hardened into a state of perpetual competition.

Can a Deal Break the Impasse?

So, what are the odds of a direct China-U.S. deal? In the short term, don’t hold your breath. History offers a sobering lesson: during Trump’s first term, the Phase One trade deal crawled to fruition over two grueling years (2018–2020), and even then, it was a limited patch on a fraying fabric. Today, the prospects look even dimmer. Neither side has the appetite—or the leverage—to bend.

For the U.S., tariffs are a double-edged sword. They’re a tool to punish China and lure manufacturing back home, but they also risk jacking up consumer prices—a political liability as midterm elections loom. For China, the focus is inward: pivoting to a domestic demand-driven economy while weathering external blows. These aren’t problems with quick fixes. They’re structural, stubborn, and deeply entrenched.

A Protracted Tug-of-War

The upshot is clear: a swift thaw in trade tensions is a pipe dream. Businesses and citizens alike should brace for the long haul—a landscape of sustained friction punctuated by flare-ups. This isn’t about predicting the next breakthrough; it’s about recognizing the resilience of the impasse. The Sino-American rivalry isn’t going anywhere, and neither side seems poised to blink. For now, the world watches a contest where the stakes are high, the moves are calculated, and the endgame remains frustratingly out of sight.

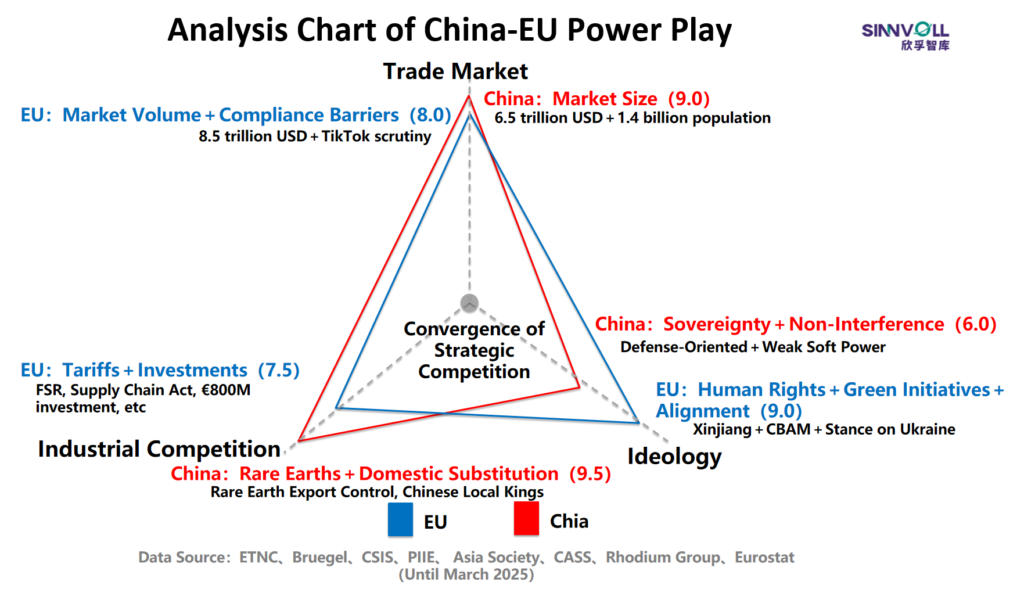

Relationship II: Sino-European – A Teetering Balance of Rivalry and Promise

The China-EU relationship is a tightrope walk—part partnership, part tug-of-war, swaying with every gust from the global stage. Unlike the bare-knuckled strategic showdown between China and the U.S., this dynamic blends hard realities with flickers of fiction, a seesaw tilting under the weight of outside forces like U.S.-Russia relations. It’s not a full-on clash, but don’t mistake it for harmony either—both sides are playing a nuanced game, eyeing each other warily while keeping the door cracked for cooperation.

Cooperation Meets Competition

At street level, the EU’s throwing up walls—subtle, but firm. Take 2024: the European Commission slapped tariffs as high as 38.1% on Chinese electric vehicles, piling on stricter green standards and anti-subsidy probes to box out Beijing’s firms. It’s not an outright ban, but it’s a clear signal: Europe’s market isn’t an open buffet. China, meanwhile, doesn’t punch back directly—it leans on “spillover” jabs. In 2023, export curbs on rare earths like gallium and germanium rattled Germany’s semiconductor chain, a quiet reminder of who holds the raw-material reins. Add China’s domestic shifts—upgraded consumption, a push for self-reliance—and European companies are scrambling to keep their foothold in a tightening market.

Yet, beneath the friction, there’s room to dance. Cooperation isn’t dead—it’s just waiting for a spark. The catch? It hinges on what the big players do next. If the U.S. and Russia cozy up first, the EU might pivot toward China, using Beijing as a counterweight to dodge a Washington-Moscow squeeze. But if the U.S. and EU lock arms instead, China’s elbow room shrinks fast. Any deal would boil down to a simple trade: China craves steady export lanes, while the EU wants supply chain armor and economic wins. Beyond the ghost of the 2021 China-EU Comprehensive Agreement on Investment (CAI)—now gathering dust—future talks could tangle over electric vehicles, subsidy spats, or even Chinese tech giants eyeing European turf.

Trump 2.0 and the Tipping Point

Here’s the kicker: in the shadow of Trump 2.0, the odds tilt toward a China-EU thaw, not a freeze. Sinnvoll Consultancy’s take is sharp—Europe’s current global bind makes China less a foe and more a necessary frenemy. Brussels doesn’t need Beijing’s love, just its restraint, a buffer against a world where U.S. unpredictability looms large. This isn’t a grand alliance in the making, but a pragmatic play: two powers circling, probing, and occasionally linking hands when the stars—or the superpowers—align.

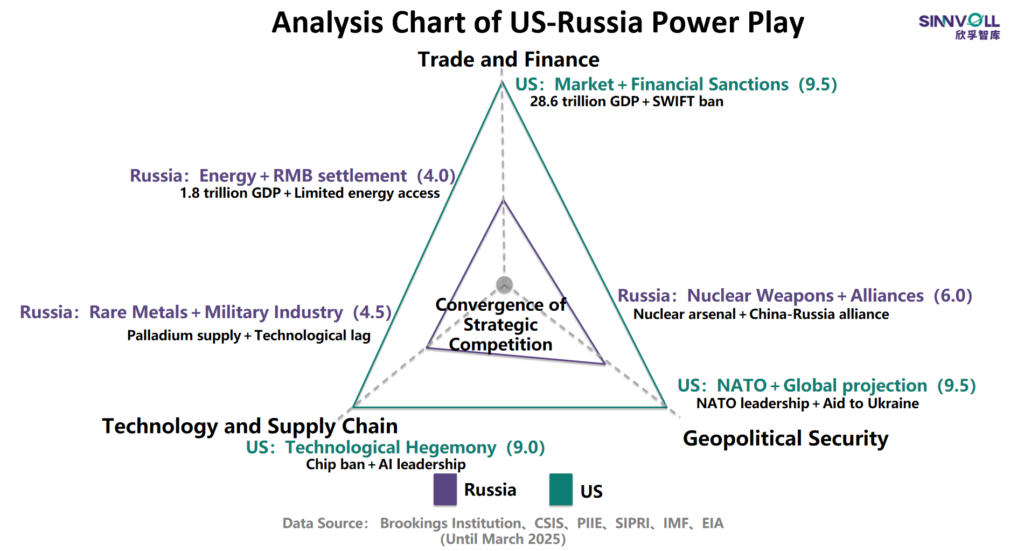

Relationship III: U.S. and Russia – From Foes to Fragile Bargainers

Sinnvoll Consultancy sees the U.S. and Russia inching from outright enemies to uneasy dealmakers—a shift from red-hot rivalry to a simmer of distrust laced with pragmatism. Trump’s return has flipped the script: tensions that flared over Ukraine are cooling, and a wary handshake might be closer than anyone expected.

Thaw Amid the Chill

The Ukraine war once had these two at each other’s throats—$100 billion in U.S. aid flowed to Kyiv from 2022 to 2024, countered by Russia’s defiance. But Trump’s 2025 pivot—slashing that support and chasing “swift conflict resolution”—changed the game. Whispers from Saudi Arabia hint at backroom talks, with Russia craving economic air and the U.S. itching to ditch the quagmire. Before, America’s sanctions and military aid crushed Russia’s leverage—its GDP, a measly 2% of the global pie in 2024, took another hit in 2025. Now, Trump’s lifeline gives Moscow breathing room, though its bargaining chips stay slim: energy exports and geopolitical swagger.

A deal’s brewing, and it could come fast. Picture Trump ceding eastern Ukraine, peeling back sanctions, and cracking open energy ties—maybe with a side order of China curbs to test Moscow’s loyalties. Russia’s too weak to dictate terms, but it’s not toothless. Distrust, though, is the wildcard—Professor Simon Evenett nails it: any pact’s a house of cards, ready to topple without warning.

A Quick Deal, a Shaky Future

The odds favor a U.S.-Russia handshake—Trump’s got the wheel, and Russia’s desperate enough to play ball. If it lands, the global board flips: China-EU talks gain steam, China feels the squeeze, and Russia’s wobble becomes everyone’s problem. But don’t bank on permanence—this is less a truce than a timeout, built on sand and suspicion.

Relationship IV: U.S. and the EU – Allies Drifting Toward Arm’s Length

Sinnvoll Consultancy sees the U.S.-EU bond bending, not breaking—unshakable allies easing into independent streaks, driven by Europe’s hunger for its own muscle, especially in defense. It’s still an alliance, but the edges are fraying.

Tension Beneath the Ties

Trump’s twisting the screws—25% tariff threats on EU goods, slashed NATO and Ukraine aid—to squeeze trade and tech wins. Von der Leyen’s “reciprocal response” sounds fierce, but the EU’s leaning in, not out—pushing joint China strategies and NATO cash (Germany’s at 2% GDP). It’s a tug-of-war with a twist: Europe craves space, yet clings tight. That wobble cracks windows for U.S.-Russia or China-EU plays, though the transatlantic knot’s too tangled to snap. The U.S. rules with NATO and tariffs; the EU swings back with its mega-market and “strategic autonomy” chant—€800 billion in plans, German debt tweaks—but it’s no match for Uncle Sam yet.

A deal’s likely, and Trump’s steering. Tariffs might ease for bigger NATO checks and tech sync-ups (think TTC). The EU’s too hooked—history and habit keep it compromising.

Trump’s Upper Hand

Washington’s got the edge—Europe’s reliance trumps its resolve. A pact’s coming, less a love letter than a hard bargain. The drift’s real, but the leash holds—for now, it’s still America’s call.

Relationship V: China and Russia – Allies Under Strain

Sinnvoll Consultancy predicts the China-Russia bromance hitting a stress test—still back-to-back, but each stacking chips to tip the scales. This strategic duo’s held firm against the U.S., but cracks are showing, and Russia’s wavering could expose a soft spot in the quadrilateral dance.

Leverage and Limits

These two have been thick as thieves, syncing up to counter Washington—China’s cash and clout shielding Russia’s flank. But Ukraine’s mess has Moscow teetering. If Russia cuts a U.S. deal—hiking energy costs to China (20% of its oil in 2024) or cozying up to contain Beijing—China’s left scrambling. Trade’s booming ($240 billion in 2024, ticking up in 2025), but a Russian pivot could choke Chinese firms abroad and rattle the partnership. China’s got the upper hand—its market and money keep Russia afloat amid sanctions (GDP growth limping at 1.5% in 2024). Moscow fights back with oil and joint drills, but it’s leaning hard on Beijing’s lifeline.

A U.S.-Russia deal could freeze new China-Russia pacts cold. China’s fix? Diversify—tap Middle East oil, juice up domestic green tech—while Russia’s stuck choosing between West and East. The alliance won’t snap soon—mutual need glues it together—but the trust’s fraying.

Testing the Ties

No breakup’s imminent, but the honeymoon’s fading. Russia’s indecision could nudge China toward EU flirtations or bolder solo moves. This duo’s still a force, but the balance is tilting—China’s grip tightens, and Russia’s room to roam shrinks. Watch this space: it’s where loyalty meets leverage.

Relationship VI: EU and Russia – Locked in a Long Freeze

Sinnvoll Consultancy calls it—EU-Russia relations are a stubborn standoff, a deep chill with no thaw in sight. Even the rosiest guess pegs peace a decade out, as war and mistrust keep these neighbors at dagger’s point.

Sanctions vs. Survival

The Ukraine war’s the fault line: €85 billion in EU aid to Kyiv from 2022-2024, 12 sanction rounds hammering Russia’s energy core. Moscow’s slashed gas flows—down from 30% of EU supply pre-war to under 10% in 2024—while flexing military muscle. The EU’s economic club hits harder, but Russia’s not folding—its GDP’s flatlining in 2024, yet it pivots to non-Western buyers. Both are hobbled: Europe’s autonomy sags without full U.S. backup, and Russia’s wallet’s too thin to call the shots. Jeffrey Sachs muses they should deal as neighbors, but reality’s a brick wall—neither budges.

Short-term? Deadlock. The EU’s gunning to drop Russian gas below 5% by 2025, while Moscow courts the U.S. and beyond. Flexibility’s off the table—both are boxed in, glaring across the divide.

A Decade of Drift

This feud’s a slow burn, not a flashpoint. No deals, no détente—just a grind that ties both hands in the quadrilateral game. The EU’s stubborn, Russia’s strapped, and time’s the only winner. Don’t hold your breath for a breakthrough.

Outlook: Thriving Amid the “Great Deal” Era’s Global Shocks

Sinnvoll Consultancy maps the quadrilateral game—U.S., Russia, EU, China—as the pulse of today’s world. One deal ignites, and the system jolts. A U.S.-Russia pact leads at 60% odds, likely mid-2025, driven by Trump’s Ukraine exit and Russia’s economic gasp. U.S.-EU follows at 50%, tied to Europe’s compromise habit, maybe late 2025. China-EU lags at 40%, a domino needing U.S.-Russia first—early 2026, if at all. Deals, not dogma, rule this dance. China’s eyeing a U.S.-Russia thaw that could jolt its Moscow ties, while EU unease might crack open Sino-European plays. This is March 2025’s read—Russian collapse or EU splits could shuffle it fast.

The “Great Deal” era rattles everyone: Chinese firms pushing global, multinationals with factories in China dodging tariff hammers, and cautious players scared to build beyond borders. Risk’s universal—here’s how to dodge the punches and land some wins.

1. Reframe the U.S. Threat—It’s a Two-Way Street

Trump’s tariff war—100% on Chinese goods, 25% looming for EU—stings hard, but it’s backfiring too. U.S. consumers ate 2024 price hikes, and tech decoupling’s chaos has EU allies grumbling. Chinese firms: don’t flinch—your 5%+ GDP growth (2024) and market gravity hold firm; focus on your edge, not U.S. noise. Factory owners in China (think Tesla, VW): tariffs bite your exports, but China’s supply chain depth and local demand are lifelines—pivot to serve Asia, not just the West. Tariffs aren’t fate—America’s industrial holes are your leverage.

2. Map the Chaos, Move Smart

Geopolitics is a minefield—step carefully. Chinese companies shifted factories to Vietnam or Mexico past seven years—some electronics aces kept U.S. shelves stocked. But missteps hurt: 2023-2024 solar plants in Southeast Asia got tariff-slapped, and 2025’s U.S. “nearshore” squeeze hit Mexico bases. Multinationals with China factories—like Apple or Siemens—face mirror risks: exporting from Shenzhen’s pricier under tariffs, but yanking out loses China’s efficiency edge. Weigh it—labor costs, policy flips, local hiccups—before budging. Precision beats haste for both.

3. Bet on Tech, Not Quick Bucks

Short-term globalization’s dead—innovation’s the long game. Chinese firms like BYD thrive abroad with R&D grit—European plants dulled EU tariff pain. Factory giants in China: your Shenzhen hubs can’t just churn—you need tech to offset export hits. Huawei’s sanctions-proof R&D kept it king at home; contrast that with OEM drones bleeding under tariffs. Data’s clear—2025’s emerging markets (India, Africa) crave Chinese brands with muscle. For both: pricing power via patents trumps cheap assembly—build it, or lose it.

4. Seize the Gap, Lock In Local Roots

Trump’s solo streak buys breathing room—less “allied pressure” than Biden’s day. Chinese firms: push global now—EU’s China anxiety’s your in. Factory players in China: double down—localize harder (e.g., Tesla’s Shanghai boom) to dodge export woes. Multipolarity’s rising—EU EV tariffs, India’s rules—but smart policy teams turn friction into footholds. BYD’s Europe bet paid; blind leaps flopped. Both need local love—factories alone won’t cut it without fans and finesse. Strategy’s king.

The Play Ahead

This era’s a gauntlet—macro shifts hit hard. Chinese firms: use EU cracks, brace for Russia wobbles. Companies with China factories: lean on its strengths, tech up, localize fast—tariffs don’t kill if you adapt. No one’s immune, but the nimble win. China’s not sinking, and panic’s a loser’s game. From Guangzhou to German-owned plants, the sharp-eyed grab this “Great Deal” chaos and turn it golden.