Saudi Arabia is currently undergoing its most significant period of reform and opening up in its entire history. In a relatively unassuming manner, it has become one of the most sought-after locations for Chinese enterprises seeking to expand their operations on the international stage. The advent of business opportunities in Saudi Arabia on the global stage is now becoming apparent.

When people think of Saudi Arabia, they often envisage an endless expanse of desert, abundant oil resources, women in black robes and wealthy men in white robes. However, these images are now part of the past. In the past five years, Saudi Arabia has undergone revolutionary changes.

In the present era, Saudi Arabia is engaged in the active development of its nascent energy industry and the establishment of nascent urban agglomerations in the desert. Concurrently, it is pursuing the emancipation of women and welcoming tourists from around the globe. This historically old Islamic country has now become a market of considerable interest to global capital and enterprises.

Meanwhile, China’s commercial and political relations with Saudi Arabia are becoming increasingly robust. In 2022, China played a pivotal role in facilitating a peace agreement between Saudi Arabia and Iran. In the same year, the Chinese leader participated in the China-Saudi Arabia Summit, during which 34 investment agreements were concluded between the two nations. Unconsciously, Saudi Arabia has become a primary destination for Chinese enterprises seeking international expansion, offering business opportunities that are now prominently showcased on the global stage.

This article, which draws on insights and research from a number of experts at Sinnvoll Consultancy, seeks to delineate the characteristics of the Saudi market from a variety of viewpoints, including historical, political, economic, and other perspectives. At this critical juncture, the objective is to provide Chinese global enterprises seeking international expansion with enhanced decision-making support. One certainty remains: Saudi Arabia is currently experiencing its most significant period of reform and opening up in its history, it means that the value of investment in the Saudi market is not what it used to be.

What were the factors that led Saudi Arabia to move from a state of traditional isolation to one of reform and opening up?

In order to have a full understanding of Saudi Arabia’s macro-environment, one must first have a grasp of its complex political landscape.

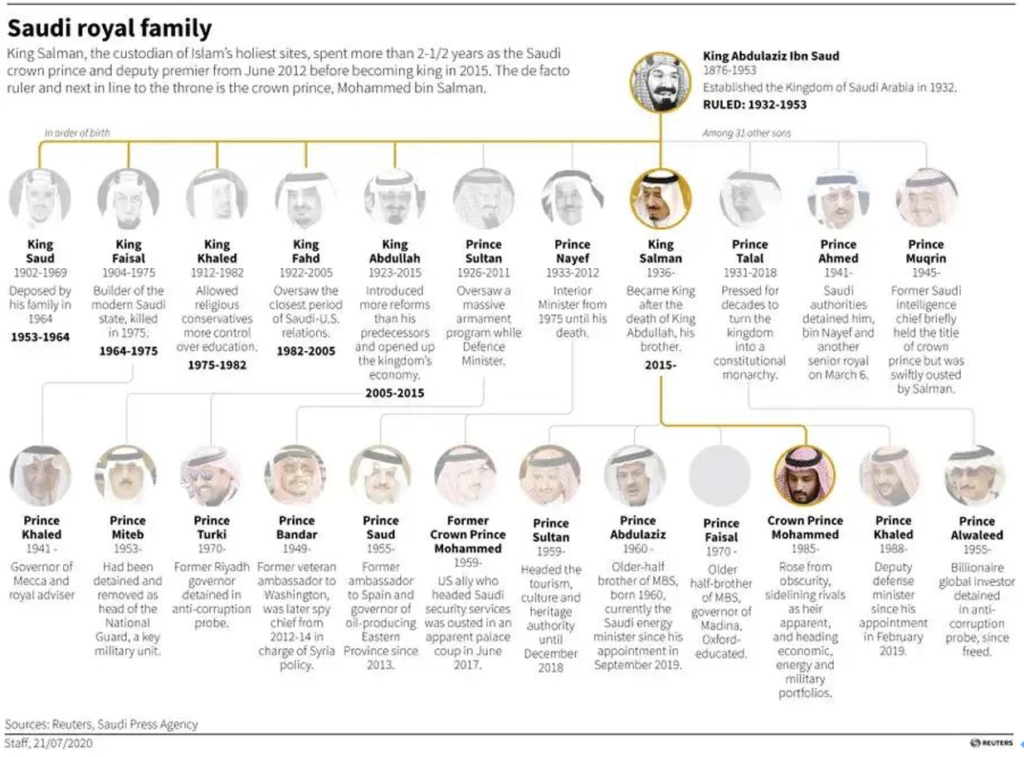

Saudi Arabia, a relatively young country established by Ibn Saud in 1932 through the unification of various tribes and regions, operates as an absolute monarchy with Islam as its state religion. In a manner reminiscent of historical religious states, power is divided between two primary factions. The Banu Saud family holds political power, while the Wahhabism controls religious authority. Traditionally, Saudi Arabia’s monarchy has adhered to a “brother succeeds brother” succession policy, whereby a king’s successor is typically his brother. However, recent developments indicate a shift towards a “son succeeds father” approach.

The historical system of succession within the Saudi royal family has historically been characterised by a certain degree of instability. This potential source of instability is currently being addressed. Looking back to 1992, the Basic Law of Saudi Arabia has stipulated that the successor to the throne must be a direct descendant of Ibn Saud, subject to the support of senior family members and religious authorities. In the absence of a strict “father to son” succession rule, all direct descendants of Ibn Saud have been eligible to vie for the throne, thereby fostering a persistent environment of intense competition and a high incidence of coup attempts among uncles and nephews. In 1964, King Saud was deposed by his younger brother Faisal in a coup and subsequently exiled. Subsequently, in 1975, King Faisal was assassinated by his nephew, Prince Fahd.

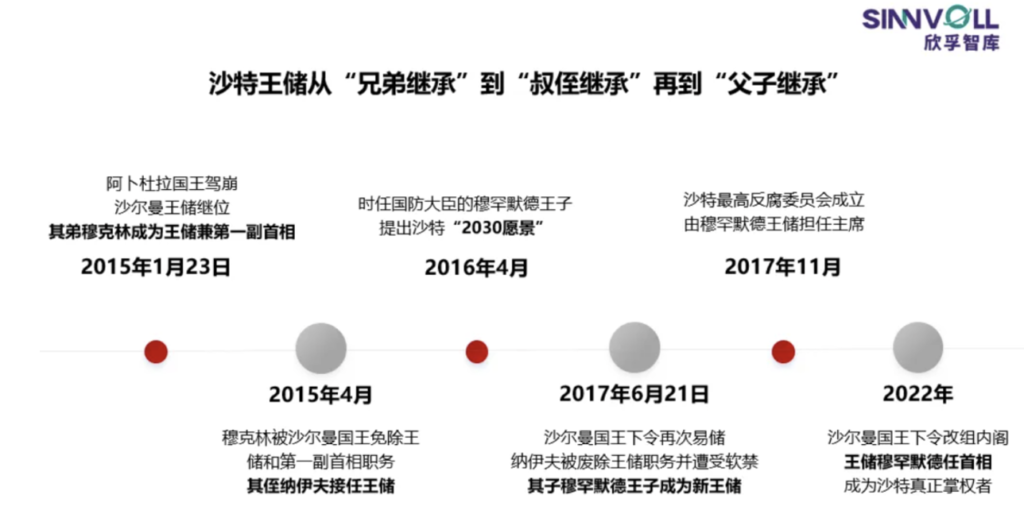

However, between 2015 and 2017, there was a notable shift in the circumstances surrounding the situation. On 23 January 2015, King Abdullah passed away, and his brother, King Salman, ascended to the throne. At that time, Salman appointed his younger brother Muqrin as Crown Prince and First Deputy Prime Minister. Their nephew, Nayef, was designated as Deputy Crown Prince. In April 2015, King Salman stripped Muqrin of Crown Prince and First Deputy Prime Minister, thereby elevating Nayef to the position of Crown Prince. Furthermore, Nayef was appointed to the roles of First Deputy Prime Minister, Home Secretary, and Chairman of the Council for Political and Security Affairs. Furthermore, the king’s son, Muhammad, was appointed as Deputy Crown Prince. This represented a historic shift in the transfer of power to a new generation in Saudi Arabia. Since than, a significant portion of Saudi Arabia’s authority has been concentrated under the control of Nayef and Muhammad, who are cousins.

Following Nayef’s appointment as Crown Prince, he was lauded by Western nations. At that time, American officials, scholars, and media outlets offered praise for this decision. In April 2016, French President Hollande bestowed the Legion of Honour upon Nayef, and Time magazine recognized him as one of the 100 most influential people globally that same month. Nevertheless, despite attaining the pinnacle of his influence, Nayef could not have foreseen that in 2017, he would be confronted with a situation analogous to his uncle’s, being compelled to relinquish his position.

On 21 June 2017, King Salman ordered another change of crown prince, and the internal vote of the “Allegiance Council” responsible for selecting the heir to the throne was an overwhelming 31-3 in favor of the king’s decision to change the crown prince. Subsequently, Nayef was removed from his position and placed under house arrest, while Prince Muhammad ascended to the position of Crown Prince. In less than two years, the Saudi royal family underwent a significant transition in its succession system, moving from a “brotherly succession” model to an “uncle-nephew succession” structure and ultimately to a “son succeeding father” paradigm. This transition is widely regarded as the most significant reform of the succession process since the country’s founding. In 2022, King Salman undertook a further restructuring of the cabinet, appointing Crown Prince Muhammad as Prime Minister, thereby consolidating Muhammad’s position as the de facto ruler of Saudi Arabia.

In recent years, both Saudi society and the international community have placed considerable expectations on Muhammad, the Crown Prince, as hope and future of reform and openness in Saudi Arabia. Since assuming a prominent role, Muhammad has demonstrated the boldness and foresight that are characteristic of a leader from a new generation. Nevertheless, his approach has also been notable for its fierceness.

The following analysis will examine the biography and characteristics of Muhammad. Muhammad was born on 31 August 1985, his mother, Princess Fahda, is daughter of the chief of the Ajman tribe. Muhammad received his education in Riyadh, the capital city, and demonstrated academic excellence, ranking among the top ten students nationwide. He graduated from King Saud University with a Bachelor of Laws degree, having achieved the second-highest grade in his graduating class.

Muhammad commenced his political career in 2007. By 2009, he had been appointed as a special advisor to his father Salman, then Riyadh’s Emir (equivalent to Riyadh’s governor), and also served as an advisor to the Saudi Cabinet Committee of Experts. Following the death of Crown Prince Sultan in 2011, Salman was appointed to the positions of Deputy Crown Prince and Minister of Defence. From that time on, Muhammad assumed the role of his father’s personal advisor, accompanying him in official capacities. Following the death of the Saudi Crown Prince in 2012, Deputy Crown Prince Salman was elevated to the position of Crown Prince, with Muhammad assuming formally a role within the Crown Prince’s office.

Concurrent with his entry into the political sphere, Muhammad established numerous companies and served as an advisor to a number of foundations. He established the MiSK Foundation, which is dedicated to the advancement of learning and leadership skills among young Saudis and the encouragement of their entrepreneurial programs. In 2013, he was bestowed with the “Person of the Year” accolade by Forbes Middle East, in acknowledgement of his considerable contributions to the advancement and progress of Saudi youth.

The year 2015 was the beginning of a turnaround in Muhammad’s fortunes. His father, Salman, ascended to the throne, and Muhammad was appointed Minister of Defence, becoming the youngest Minister of Defense in the world. Additionally, in April of the same year, he was designated as Deputy Crown Prince. At the age of thirty, Muhammad initiated a series of strategic measures at the domestic and international levels with the objective of further consolidating his power.

His actions were characterised by a notable degree of decisiveness and a resolute approach. Initiating an anti-corruption campaign in 2017, he proceeded to effect the arrest of four ministers, eleven princes (including his cousins), and several prominent entrepreneurs in November of that year. In 2020, he ordered a further series of arrests, including that of prince and the former Crown Prince Nayef. On the international front, he rapidly coordinated and directed Operation Decisive Storm in Yemen, a coalition operation spearheaded by Saudi Arabia and supported by the UAE, Bahrain, Kuwait, Qatar, Egypt, Morocco, Sudan, and Jordan. The operation involved a series of military actions, including airstrikes, missile attacks, and ground operations against Yemen, with the objective of restoring control to the Yemeni government and dislodging the Houthi movement from their positions. In 2018, the murder and dismemberment of journalist Jamal Khashoggi, critic of Muhammad at the Saudi consulate in Turkey constituted a significant global shock. Muhammad was identified by U.S. intelligence agencies as the alleged mastermind behind the operation. Nevertheless, as time elapsed, the scandal gradually receded from public consciousness.

Notwithstanding the considerable political struggles and widespread criticism he has faced, it is beyond question that Muhammad has initiated far-reaching reforms across a range of sectors, including society, law, the economy and culture, upon assuming his position of authority. These reforms have included efforts towards secularisation, such as the lifting of the ban on women wearing headscarves, as well as initiatives aimed at comprehensive modernisation and increased openness.

These reforms demonstrate the resolve of the Saudi ruling class to effect social change and reflect the country’s ongoing commitment to deeper reform and greater openness. A stable and authoritative government is essential for sustaining the long-term potential of the Saudi economy.

Why the “Three Transformations” set the stage for Saudi Arabia’s future?

In the context of political stability, the direction of fundamental reforms becomes critically important.

In accordance with the statistics published by the International Monetary Fund (IMF), the gross domestic product (GDP) of Saudi Arabia reached $833.5 billion in 2022, which positioned the country as the 18th largest economy globally. From 1969 to 2021, Saudi Arabia’s GDP exhibited an average annual growth rate of 4.8%, positioning it as one of the fastest-growing economies among emerging nations in the present era.

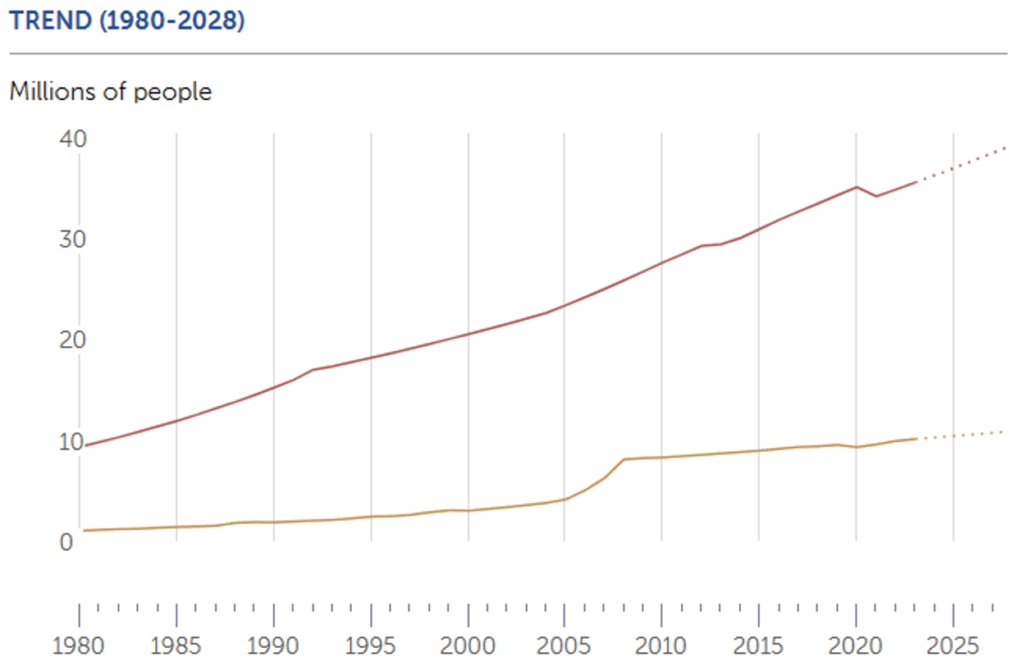

In 2023, the population of Saudi Arabia was 35.5 million, with continued growth projected to reach 39.2 million by 2028. In contrast, the United Arab Emirates (UAE), Saudi Arabia’s primary economic competitor, has a population of just 10.09 million and is already experiencing a stagnation in growth.

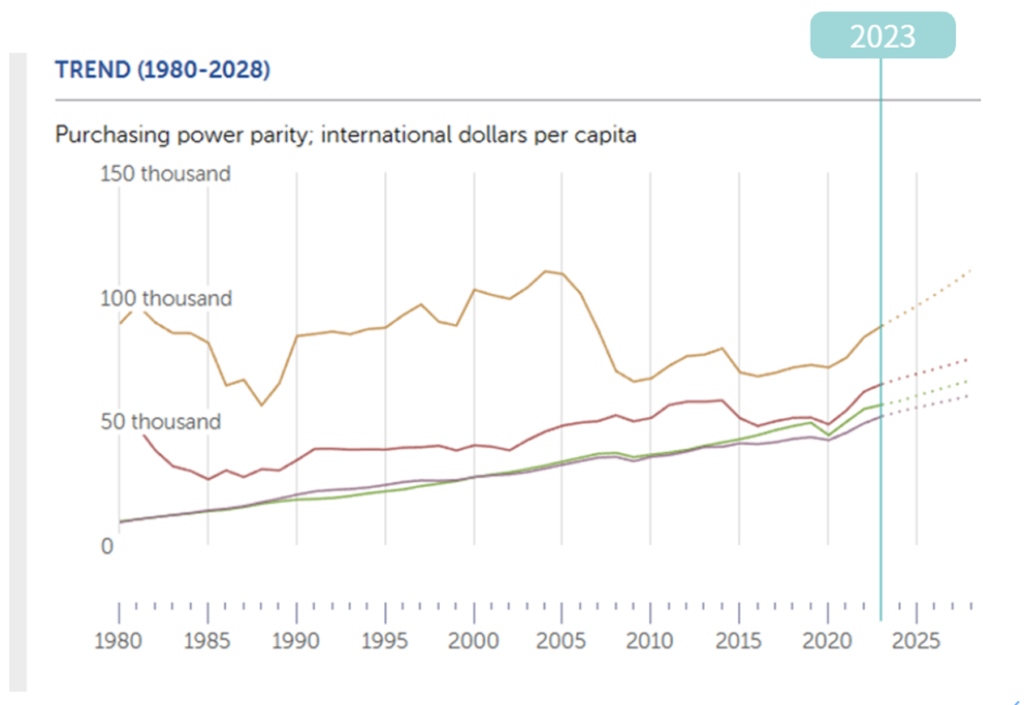

In aggregate, the populations of Saudi Arabia and the UAE are relatively modest in size, yet their purchasing power remains exceptionally robust. In 2023, the per capita income in Saudi Arabia was $69,000, while in the UAE it was even higher at $88,000. By way of comparison, the per capita incomes in the UK and Japan are $56,000 and $52,000, respectively. The evidence of economic advancement during these years is unmistakable.

What reforms are responsible for Saudi Arabia’s accelerated economic growth? In summary, Sinnvoll Consultancy identifies three key transformations: a shift from oil dependence to renewable energy sources, a transition from fossil fuel exports to a service-oriented economy, and a move from a privileged economy to a market economy. All three reforms are extremely important for the economic development of this country!

Firstly, let us analyse “the shift from oil dependence to renewable energy sources”.

Saudi Arabia is home to approximately 16% of the world’s proven oil reserves, making it the second-largest oil exporter globally and a pivotal member of the Organization of the Petroleum Exporting Countries (OPEC). The oil sector accounts for 87% of Saudi Arabia’s revenue, 42% of its gross domestic product (GDP), and 90% of its export income. It is evident that oil has constituted the bedrock of the Saudi Arabian economy. Despite extensive Western criticism of Saudi politics and Wahhabism in the decades following World War II, the regime remained stable, largely due to the global economy’s heavy reliance on oil.

Nevertheless, historical evidence indicates that Monopolists are also at high risk of being subverted. Despite Saudi Arabia’s extensive oil reserves, which could be extracted for nearly hundred years, leaps and growing maturity in shale gas extraction technology in the United States have introduced considerable competitive pressures on the oil industry. Moreover, the sustained advancement of renewable energy technologies over the past two decades, coupled with an increased global awareness of climate change, has resulted in a general decline in global oil demand.

The direct consequence has been a reduction in the control that Saudi Arabia and its OPEC allies exert over oil pricing. In 2015, Saudi Arabia’s GDP underwent a notable decline, predominantly due to the precipitous decline in Middle Eastern crude oil prices, which fell to approximately half of their 2014 levels. Despite a resurgence in oil prices during the Russia-Ukraine conflict, this surge proved to be transient, with prices subsequently reverting to their original levels. While oil has historically been a significant contributor to Saudi Arabia’s economic success in the 20th century, it could just as easily bring down Saudi Arabia in the 21st century. By 2015, Saudi Arabia standed at a fork in history, with only two potential courses of action available: to pursue reform and openness, or to accept economic decline.

Muhammad identified the reform of energy dependency as a central objective. Upon assuming the role of Deputy Crown Prince in 2015, he initiated a series of reforms, the most notable of which is the “Vision 2030” plan. This initiative advocates for economic diversification and privatisation as a means of reducing reliance on oil. His proposed strategy entails the utilisation of oil revenues to support renewable energy projects. In particular, this entails the issuance of an initial public offering (IPO) of the state-owned oil company, Saudi Arabian Oil Company, with the proceeds being allocated towards the advancement of renewable energy.

In December 2019, Saudi Aramco conducted an initial public offering (IPO) on the Saudi Stock Exchange, selling 1.5% of its shares and raising approximately $25.6 billion. In September 2023, the government of Saudi Arabia considered the sale of company shares with a value of approximately $50 billion, with the objective of reinforcing investments in the country’s sovereign wealth fund. In a public statement, Crown Prince Muhammad asserted that additional offerings of Saudi Aramco shares would be made in the coming years, with all proceeds being allocated to the Public Investment Fund.

Crown Prince Muhammad is aware of the ongoing decline in the significance of oil to Saudi Arabia. It is therefore essential to swiftly marketise assets and prioritise investments in renewable energy within the present timeframe. Otherwise it would be pointless for the Saudis to own even 100% of Saudi Aramco once renewable energy continues to break through in the future and oil is worthless.

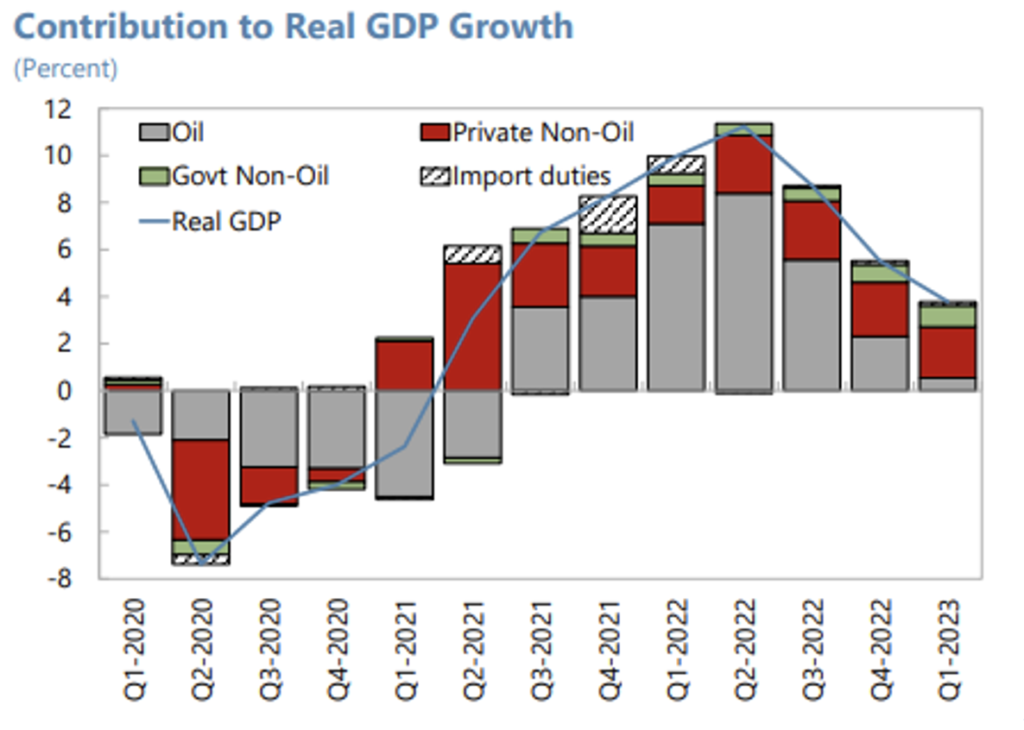

The implementation of this strategy began to yield results in early 2021, as evidenced by the graphical representation. The contribution of oil to GDP growth is in decline, whereas that of the private non-oil sectors is stabilising and strengthening. Although oil will likely remain Saudi Arabia’s primary source of income for the next five to ten years, its contribution to GDP growth will continue to decline. The implementation of this transition presents a significant challenge for Saudi Arabia, a historically conservative kingdom. However, it establishes a robust foundation for comprehensive national development.

Secondly, considering the shift “from fossil fuel exports to a service-oriented economy“.

Prior to 2015, the Saudi Arabian economy was significantly reliant on oil as its primary source of revenue, with the sector accounting for approximately 90% of export earnings and 42% of GDP in 2016. The agricultural and service sectors in Saudi Arabia have been slow to develop. However, with the introduction and implementation of Crown Prince Muhammad’s “Vision 2030,” Saudi Arabia has adopted a new mantra, namely that “tourism is the new oil of Saudi Arabia.” The country has set an ambitious target of attracting 100 million global visitors by 2030.

On the policy front, Saudi Arabia was announced that for the first time ever, doors have been opened to travelers from all over the world from 2019 and digital visas have been introduced. Prior to this, visas were primarily available to a select group of businessmen, labourers, and pilgrims. Moreover, Saudi Arabia has pledged to invest a total of $550 billion in the expansion of the tourism sector by 2030, in order to meet the needs of more tourists. This initiative represents the largest global investment in tourism to date, with plans in progress to construct up to 42,000 hotel rooms.

In 2022, Saudi Arabia welcomed a total of 940,000 visitors, including 770,000 international tourists, representing a 22-fold increase compared to pre-pandemic levels. According to data from the UN World Tourism Organization, the Saudi Arabian tourism sector is experiencing a period of significant growth, currently ranking as the fastest-growing travel destination worldwide. The organisation forecasts that by 2032, the contribution of tourism to Saudi Arabia’s GDP will reach 63.5 billion Saudi Riyals, representing 17.1% of the total GDP.

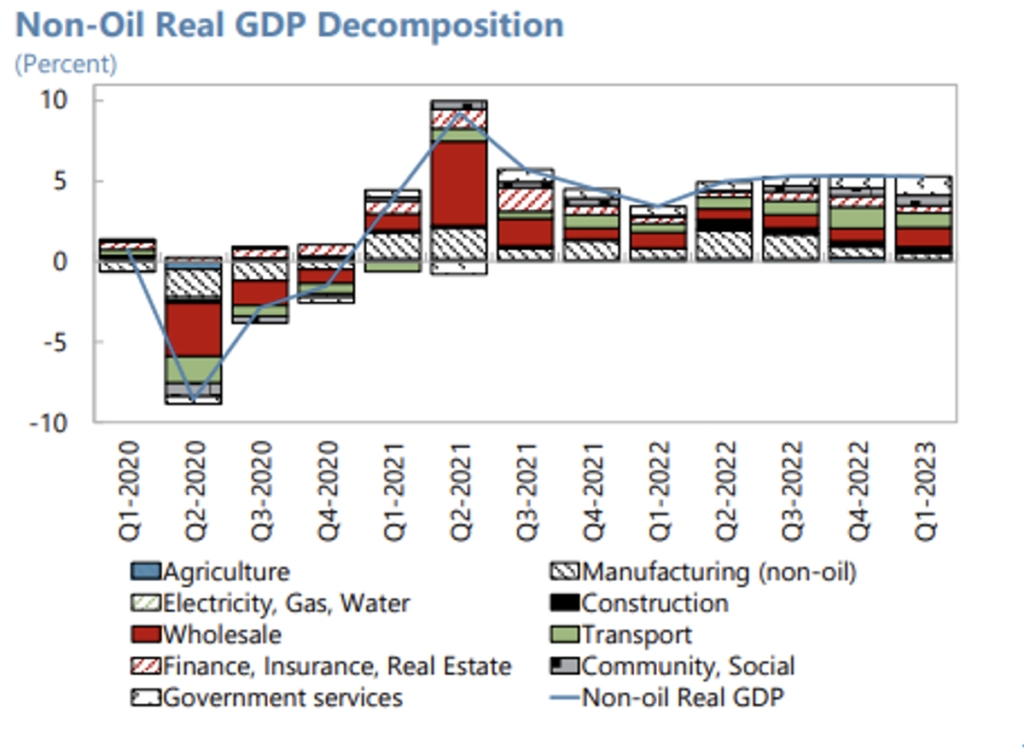

It is conceivable that individuals who initially arrived in Saudi Arabia in the 1930s for the purpose of oil exploration may subsequently visit in 2030 for reasons related to tourism. The expansion of the tourism industry has stimulated the growth of numerous other sectors in Saudi Arabia, including real estate, hospitality, catering, and retail. The contribution of the service sector to GDP has been on a consistent upward trajectory, with the IMF noting that in 2021, it constituted over 50% of Saudi GDP, thereby becoming the largest industry.

The accelerated development of the service sector has resulted in a notable increase in employment opportunities within Saudi Arabia. By 2022, the country had reached a historic low in its overall unemployment rate, which stood at 4.8%. It is noteworthy that the unemployment rate among young people aged 15-24 has decreased by 50% to 16%. This considerable reduction serves to illustrate the transformative effect of the “Vision 2030” initiative on Saudi Arabia’s economic structural reforms.

The Chairman of the Saudi Tourism Council observed that over the past decade, one in every five new jobs in Saudi Arabia has been generated within the tourism sector. He further noted that this proportion is expected to rise to one in every four new jobs in the coming decade. In contrast to the manufacturing and agricultural sectors, where artificial intelligence (AI) is set to exert a considerable influence on the workforce, the tourism industry relies on a workforce comprising service personnel, a dynamic that is unlikely to change. Despite not being traditionally regarded as a sector, tourism undoubtedly plays a pivotal role in shaping the national ethos, thereby underscoring the significance of this progressive initiative.

Thirdly, what’s more important, it’s “the transition from a privileged economy to a market economy”.

As previously stated, the government of Saudi Arabia is an absolute monarchy. Given that the economy is primarily controlled by the royal family and heavily dependent on oil, significant issues of high-level political corruption persist. Nevertheless, numerous international research institutions have thought that over the past two decades, corruption has penetrated downward due to modest increases in living expenses and stagnant wages. Even the initially affluent tiers of government administration have begun to face corruption. Nevertheless, in comparison to less affluent Arab nations such as Egypt and Syria, instances of administrative corruption within the Saudi Arabian government remain relatively uncommon.

The absence of disclosure regulations in Saudi Arabia results in a lack of true public accountability systems for government officials. Saudi Arabia’s parliament hold reservations specific cases of misconduct, while the media generally maintains a moderate stance, with the exception of a few notable instances. Internally, Saudi Arabia has implemented some anti-corruption mechanisms, such as administrative oversight bodies and disciplinary committees for public servants. However, these mechanisms often yield limited results. Consequently, the prevalence of corruption correlates closely with the personal integrity of individual ministers, significantly influencing corruption levels within their respective departments. In other words, the king simply could not effectively supervise the activities of his elder brothers in their respective departments.

Moreover, Saudi Arabia is characterised by a lack of an independent judiciary and a transparent administrative system. The Saudi judicial system is based on an Islamic legal framework, which encompasses both Islamic law and Saudi law. The judiciary is divided into two distinct tiers: the Supreme Court, which bears responsibility for the oversight and management of the national judicial system, and lower courts, which are tasked with the adjudication of the majority of criminal, civil, and commercial cases. Saudi Arabia’s judicial system is characterised by a conservative approach, with a rigorous interpretation and enforcement of laws and robust measures against criminal activities. This demonstrates effectiveness in maintaining social order and combating crime. Nevertheless, the integration of Islamic law gives rise to considerable controversy surrounding the rights of the individual.

Muhammad, a member of the royal family, is acutely aware of the pervasive corruption within Saudi Arabia, more than half of which originates from within the royal family itself. To illustrate, members of the royal family are not obliged to reveal their financial involvement in semi-public business transactions. This enables the covert manipulation of operations despite the apparent presence of corporate governance. Furthermore, the national judiciary easily subordinates its authority to that of the royal family, particularly in cases pertaining to land registration and disputes. This results in judgments that are biased in favour of the royal family, causing injustice to third parties. In addition, the absence of robust whistleblower protection and the scarcity of comprehensive media coverage have contributed to the country’s enduring reputation as one of the most corrupt globally.

One of the first things Muhammad did when he gained real power in 2017 was to set up an anti-corruption commission. He took the initial step of establishing an anti-corruption committee. In the course of its first round of anti-corruption investigations, a considerable number of individuals belonging to the royal family, prominent businessmen, former officials, senior clerics, public intellectuals, scholars, as well as human rights and women’s rights activists, were apprehended. Some detainees reached settlements with the committee, resulting in the state recovering $107 billion USD.

In a move spearheaded by the Crown Prince, Saudi Arabia has undertaken a comprehensive revision of its existing Anti-Corruption Act and Competition law. The objective of this initiative is to reinforce transparency and oversight mechanisms in order to more effectively combat corruption.

A report by Transparency International indicates that Saudi Arabia achieved a score of 51 points in its overall business environment in 2022, ranking third among Gulf countries, behind the UAE (67 points) and Qatar (58 points). For the Crown Prince, promoting the transformation of the entire economy into a market requires more than just selling stocks for sovereign investment; it is more important to promote the opening up of the economy so as to promote reforms through opening up. It is of the utmost importance to promote economic openness in order to drive effective reform. In essence, the realisation of a genuine transition to a market economy necessitates the harmonisation of internal and external considerations.

In conclusion, the future economic prospects of Saudi Arabia are highly dependent on the results of three ongoing transformations, each of which presents various challenges. These include struggles between traditional and progressive factions, regional conflicts that impede Saudi development, and international oil prices coupled with global expectations and critiques of Saudi Arabia.

It could be argued that the 38-year-old Crown Prince was long past the point of no return, and any misstep could cost him the chance to lead Saudi Arabia out of its predicament.

What are the potential opportunities for Chinese enterprises in the Saudi Arabian market?

The implementation of substantial political and structural reforms in Saudi Arabia has resulted in a notable economic revitalisation within the country.

The issue of economic development in arid zones has constituted a principal concern for Saudi Arabia for an extended period. The Crown Prince’s answer to this dilemma is to create a new oasis. In his “Vision 2030”, the Crown Prince announced the construction of a $500 billion NEOM mega-city cluster. The project is located in northwestern Saudi Arabia, potentially extending to Egypt’s Sinai Peninsula and Jordan. Spanning an area of 26,500 square kilometres, approximately four times the size of Shanghai, NEOM will prioritize the development of sectors including energy, water resources, biotechnology, food production, advanced manufacturing and entertainment. Overall, this project aim to achieve self-sufficiency through reliance on wind and solar energy.

NEOM is comprised of four primary project areas: The Line, Sindalah, Trojena, and Oxagon. Of these, The Line is a linear city measuring 500 meters in height, 200 meters in width, and stretching 170 kilometers in length. Its periphery is encircled entirely by mirrored glass and designed to accommodate 9 million residents.

Moreover, the NEOM project encompasses developments on both terrestrial and glacial terrain. Sindalah features a resort situated on the Red Sea that is oriented towards ocean activities, Trojena serves as a mountain tourism destination, and it is scheduled to host the 2029 Asian Winter Olympic Games. Oxagon is conceived as the inaugural fully integrated and automated port and logistics hub on a global scale. Strategically situated as a pivotal node in the global trade network, it is designed to be powered by renewable energy sources.

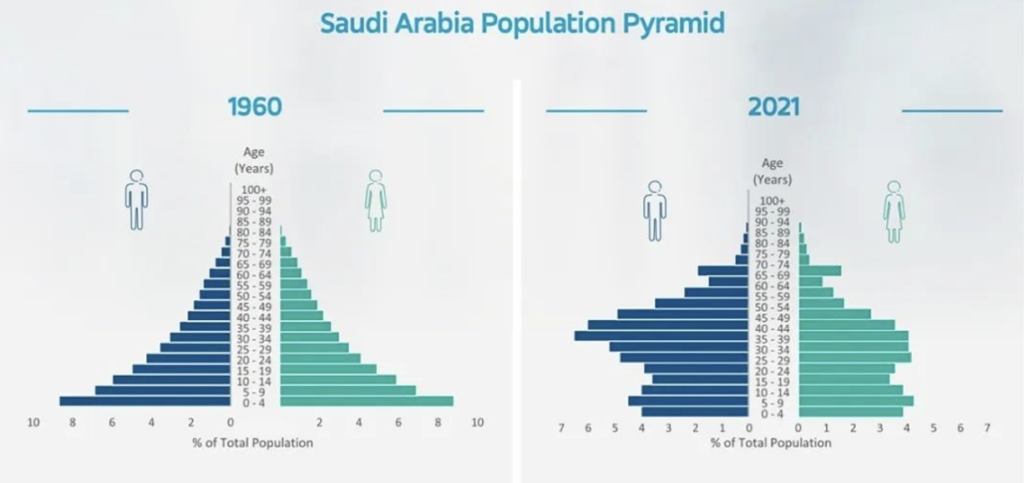

Once urban clusters have been established, the subsequent objective is to attract a population. In terms of demographics, Saudi Arabia is characterized by a relatively young population, with 63% of its residents falling within the 30 years of age or younger category, individuals aged 65 and above constitute less than 3% of the total population. Saudi Arabia is a radical conservative Wahhabism that espouses a strict adherence to the teachings of Islam. As a result, it is considered fundamentalist and has very strict requirements for the behavior of women in particular. It is therefore unlikely that the Saudi economy will attract a significant number of young people unless they are emancipated.

In accordance with this objective, the Crown Prince has advocated for cultural and social reforms since assuming power with the intention of mobilizing more individuals within Saudi Arabia for economic development and attracting global talent. To illustrate, He advocated the promotion of a more tolerant Sunni Islam, curtailed the powers of religious police, and established a Ministry of Entertainment. He called for expanding entertainment options for Saudi youth, including the lifting of the 35-year ban on cinemas. As a result of his influence, more younger Saudi Muslim scholars are being integrated into the Council of Senior Scholars with the objective of overthrowing more confining traditions.

Moreover, there have been notable advancements in the improvement of women’s rights. For example, reforms have been implemented with the objective of achieving gender equality in inheritance rights, thereby ensuring equal rights for men and women to inherit property. In addition, a series of changes of policy have been adopted, including the legalisation of women driving from 2018, allowing adult women to independently travel abroad from 2019, enabling adult women to apply for passports on their own from 2021, and the introduction of legislation in 2022 aimed at safeguarding women from sexual harassment and prohibiting gender discrimination.

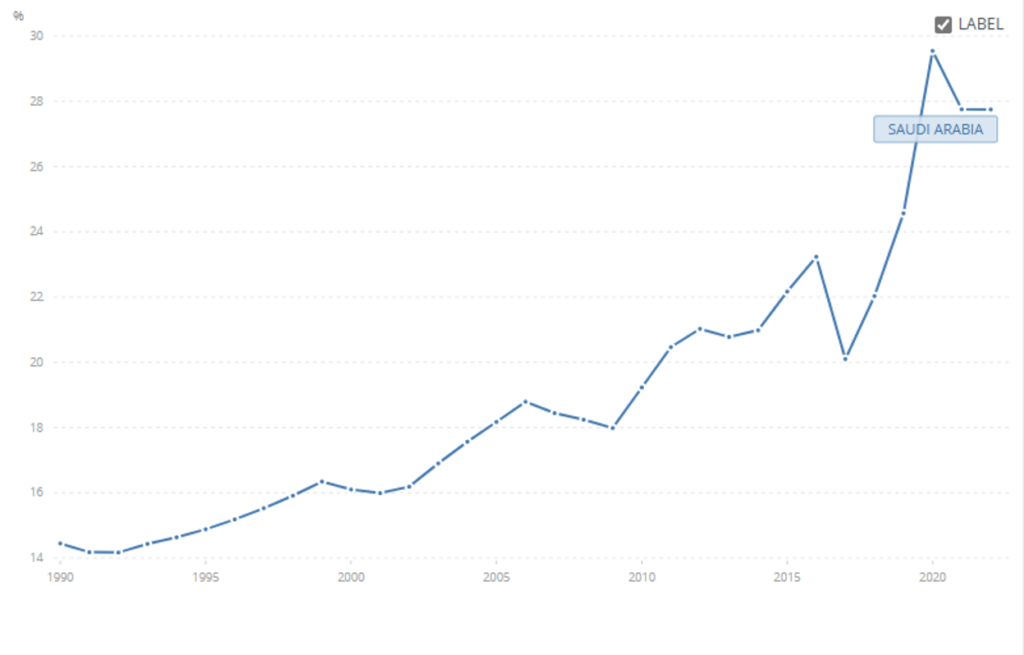

The participation of women in the workforce in Saudi Arabia is increasing, which is leading to significant increases in productivity. Although Saudi women were hedged by conditions, as evidenced in the World Bank’s 2023 “Women, Business and the Law” report, which ranks Saudi Arabia relatively low at 136 out of 180 countries, progress has been notable since the introduction of “Vision 2030.” Women are given more opportunities for career development. An increasing number of women are pursuing higher education and are entering fields such as science, technology, engineering, and mathematics (STEM). The proportion of businesses led by Saudi women has increased markedly, from 21% in 2016 to 45% in 2022. Concurrently, women’s representation in the job market has risen from 20% in 2017 to 28% in 2022.

As a consequence of these economic policies, Saudi Arabia was ranked third in the Middle East and sixth globally in the 2023 Emerging Markets Confidence Index for Foreign Direct Investment, as published by Kearney. This accomplishment is indicative of the nation’s robust domestic growth rate, promising fiscal outlook, and accelerated progress towards economic diversification objectives, which collectively serve to establish it as a prominent global investment destination.

It is evident that Saudi Arabia has garnered a growing interest from businesses and investors. From the standpoint of the investment environment, this naturally presents significant opportunities for Chinese companies.

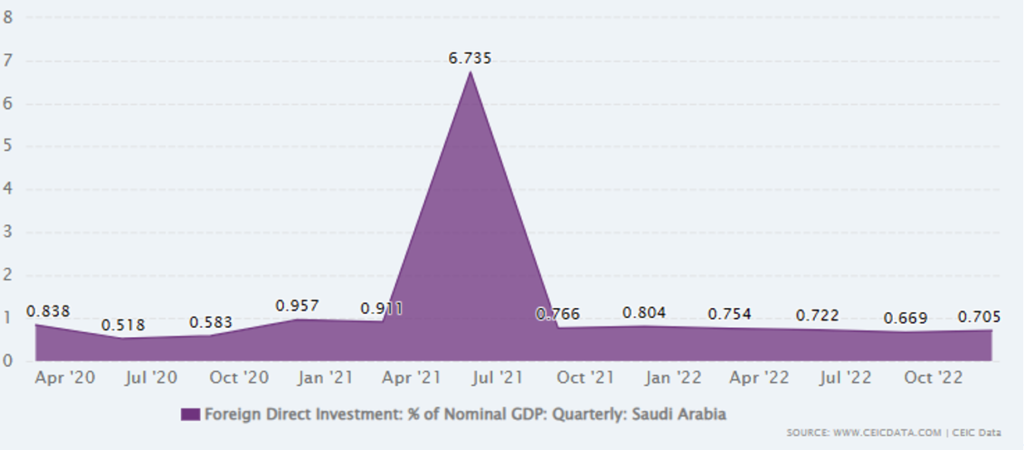

First, Saudi Arabia’s policy to attract foreign investment is very clear. A principal objective of the “Vision 2030” initiative is to increase the proportion of foreign direct investment (FDI) in gross domestic product (GDP) from 3.8% to 5.7%. A number of sectors have been identified as priority areas for both foreign and domestic investment, including chemistry, information technology, transportation and logistics, healthcare and life sciences, real estate, education, tourism, entertainment, manufacturing, mining and metals, and renewable energy.

Then, in contrast to the initial stages of development in China, India, and other emerging markets, Saudi Arabia allows foreign nationals to hold 100% ownership of projects. By establishing a range of investment policies and enhancing the transparency of incentive measures, Saudi Arabia is able to facilitate foreign investors’ comprehension of and access to its market better.

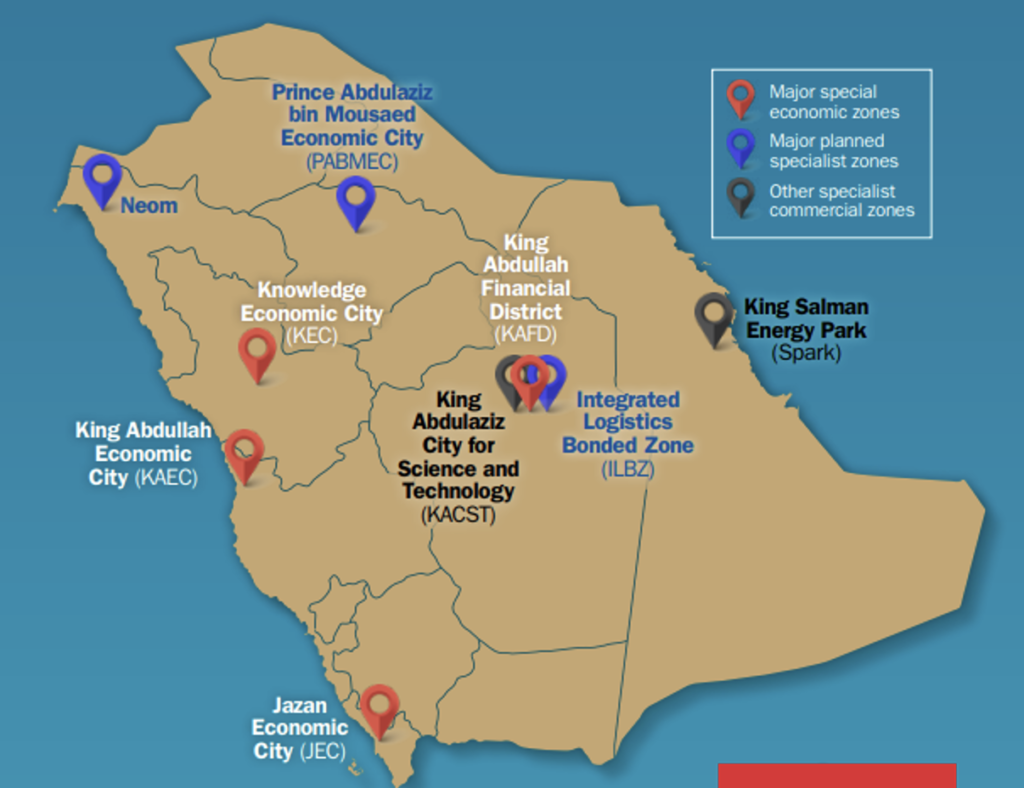

Currently, Saudi Arabia lacks the presence of free trade zones or free ports. Nevertheless, the Saudi Arabian government has established a number of special economic zones, as illustrated in the diagram below. In 2021, the inaugural Integrated Logistics Bonded Zone (ILBZ) was established in the capital city of Riyadh. Foreign companies operating in Riyadh are afforded a number of incentives, including a 50-year tax policy, complete ownership rights, full tax exemptions, and waivers on restrictions regarding capital repatriation.

Finally, the Saudi Arabian stock market has been opened to foreign investors. Since 2019, non-financial companies have been permitted to list on the Tadawul (Saudi Stock Exchange), thereby enabling overseas investors to acquire controlling stake.

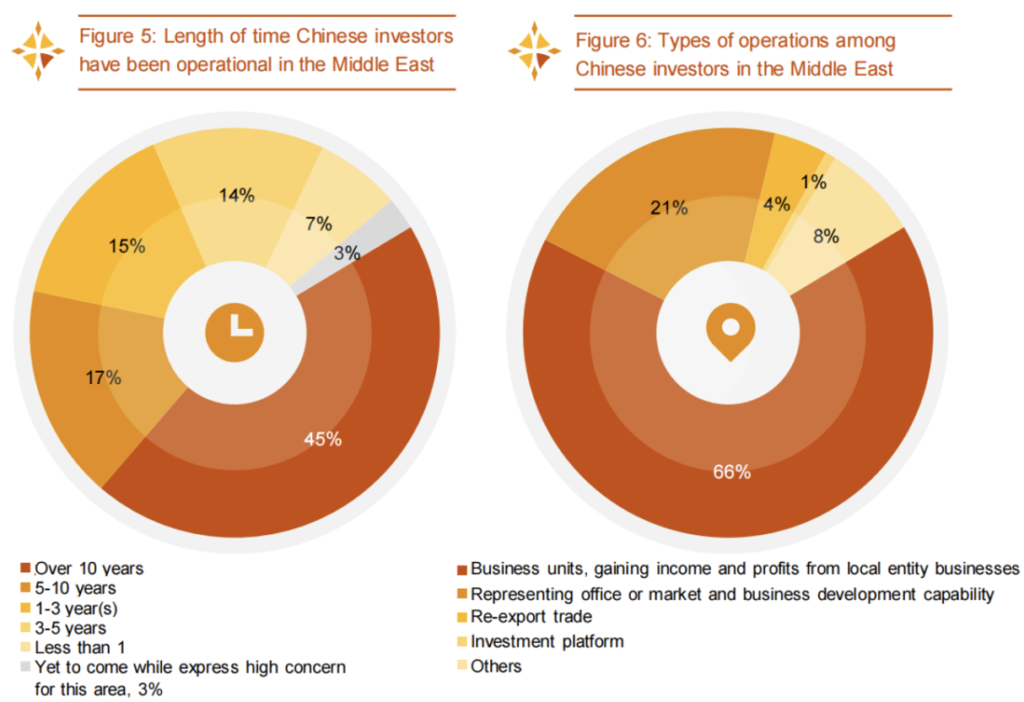

Nowadays, some Chinese companies that have keenly discovered the business opportunities in Saudi Arabia have actually begun to land in the country. The initial cohort of Chinese companies entered the Saudi market following 2015, with a primary focus on the energy and infrastructure sectors. These include CNPC, Sinopec, Power Construction Corporation of China, China Energy Engineering Group, SEPCO Electric Power Construction Corp, Xuzhou Construction Machinery Group, Zhongding International Certification Co., Ltd, China Railway Group Limited, China National Chemical Engineering Third Construction Co.,Ltd, STATE GRID Corporation of China, China Power Engineering Consulting Group International Engineering Co.,Ltd., and Zhongjiang International. In that year, information and communication technology (ICT) companies such as Huawei and ZTE also commenced operations in the Saudi market during this period. In collaboration with Saudi Aramco and King Fahd University of Petroleum and Minerals (KFUPM), Huawei established the Huawei Oil & Gas Joint Innovation Center in Dhahran Techno Valley.

Indeed, in addition to large-scale infrastructure projects, high-tech industries such as cloud computing and artificial intelligence (AI) are increasingly focusing on Saudi Arabia. In 2018, SenseTime entered the Saudi market and established a joint venture with the Saudi Public Investment Fund. The objective of this venture was to develop local talent and to deliver advanced AI solutions to clients in the Middle East and Africa. Moreover, SenseTime has collaborated with the Saudi Data & AI Authority (SDAIA) to implement an AI educational program. This initiative provides comprehensive training to educators and learners on a national scale, with the objective of cultivating interest in AI and enhancing their competencies. Concurrently, Alibaba Cloud, Tencent Cloud, and Huawei Cloud have commenced their respective expansions into the Saudi market since the previous year.

During the period of the global pandemic, the sector of global e-commerce experienced a period of significant growth, the same is true for Saudi Arabia. SF Express and J&T Express promptly capitalized on this opportunity by rapidly entering the Saudi market. Following an initial trial period, J&T Express expanded its regional operations in 2022, establishing dual hubs in Saudi Arabia and the UAE. This resulted in extensive coverage across all provinces. In Saudi Arabia, J&T Express operates seven sorting centers, its last mile delivery service that can cover the whole of Saudi Arabia. On September 17, 2023, J&T Express was the recipient of two awards at the 2023 Saudi International Finance Awards :”Last Mile Delivery King” and “Most Innovative Courier Service Provider.”

Nevertheless, despite the favorable aspects previously discussed regarding the Saudi market, numerous uncertainties remain that Chinese enterprises must closely monitor.

At present, Saudi Arabia is still in the early stages of market liberalization, with an inherently unstable market environment presenting unavoidable challenges for companies entering the Saudi market. Two other variables are whether the social changes pushed by the Crown Prince will be successfully implemented, and whether the Saudis will succeed in attracting the elite from around the globe. At present, the majority of Saudi Arabia’s immigrant population comprises expatriate laborers from South Asian countries, including India, Pakistan, the Philippines, and Bangladesh. The transformation of the city into an international metropolis remains a long-term aspiration, there is still a long way to go.

There are also challenges for Chinese companies to localize their operations in Saudi Arabia.

Firstly, the distinct hierarchical structure is a hallmark of Saudi Arabian business circles, where decisions are centralized at the highest levels. The Saudi cultural context places significant emphasis on the values of dignity and respect, which are also found in Chinese culture. Young Saudis are expected to demonstrate deference to elders, utilize appropriate titles, and should demonstrate proper obedience. This hierarchical framework also extends into the business realm, where decision-making authority is typically vested in senior executives. Consequently, an essential preliminary action in conducting business in Saudi Arabia is to ascertain the identity of key decision-makers. Obtaining approval from these senior executives is crucial for ensuring the seamless progression of business operations.

Secondly, with regard to social relations, Saudi Arabia exhibits a pronounced emphasis on the culture of human kindness. In Saudi Arabia, business etiquette differs significantly from that observed in the wider world, and this is particularly evident in communication. Body language and non-verbal expressions are often relied upon. For instance, silence is frequently perceived as an indication of contemplation; and over-filling this gap is often regarded as an indication of over-selling. Adherence to the Wahhabism is a defining characteristic of Saudi culture, with the practice of praying five times a day being of paramount importance. This ritual is observed with such strict adherence that any other activity is strictly forbidden during the designated prayer times. Additionally, the Saudi workweek is structured differently than in other countries, commencing on Saturday and concluding on Wednesday, with Thursday and Friday designated as days off.

Similar to China, Saudi Arabia places a high value on personal relationships and networks, wherein personal and business connections are often intertwined. In Saudi Arabia, forging friendships is frequently regarded as a prerequisite to engaging in business transactions. Furthermore, given the prominence of personal connections in Saudi Arabian business culture, declining requests from others may be perceived as discourteous. It is therefore imperative that those seeking to expand their networks in Saudi Arabia exercise great care in avoiding these situations.

Thirdly, Saudi Arabia displays a discernible proclivity towards local protectionism, exhibiting a preference for indigenous businesses and labor forces. This protectionist stance is evident in the continuous reforms of government procurement procedures and policies. For example, by the year 2030, the key sectors of defense and security will require that over 50% of production and procurement activities be conducted locally. Moreover, the government places significant emphasis on the ratio of Saudi citizens to foreign nationals within the workforce of companies operating within the country.

What’s more, Saudi Arabia maintains its own standards for products, in the past, they diverged frequently from those of European, American, or Japanese origin, thereby posing challenges for local businesses seeking to import industrial and consumer goods directly from other countries. The process of accessing the Saudi market with consumer products is somewhat more arduous.

In conclusion, the Sinnvoll Consultancy’s comprehensive evaluation indicates that the Saudi market is currently in its initial phases of openness, offering considerable prospects alongside notable hurdles. In particular, Saudi Arabia is experiencing a shortage of skilled management personnel with advanced expertise, and many policies and business strategies lack rigorous validation. As a result, the implementation of these initiatives often encounters challenges that can affect business operations. Secondly, due to Saudi Arabia’s conservative cultural norms, achieving overall societal openness will be a gradual evolution. Therefore, it is imperative for enterprises to prioritize understanding local culture and effectively adapting to environmental changes throughout the localization process.

From an objective standpoint, it is anticipated that the Saudi market environment will experience prolonged instability in the foreseeable future. It is probable that the extent and frequency of these fluctuations will diverge significantly from those observed in mature markets. In order to capitalize on opportunities within the Saudi market, it is essential that enterprises adopt a rigorous approach to monitoring market dynamics in order to accommodate emerging changes.

Nevertheless, it is irrefutable that Saudi Arabia’s market liberalization will inevitably transform the landscape of the entire Middle East and Arab markets. The initial stages of Saudi Arabia’s opening present a valuable opportunity for Chinese enterprises seeking to expand their global reach.